Open topic with navigation

QuickBooks Software Setup Guide

April 2016

This document provides a series of procedures to complete when installing QuickBooks accounting software to prepare it for integration with the AXIS system's Accounting module.

Note: This overview documents the setup of a new Company Profile. It is not intended for management of an existing profile.

Overview

The AXIS system's Accounting module links accounting information in the AXIS software with a third party accounting program (i.e., QuickBooks).

Consider the following before installing and setting up QuickBooks software:

- The Accounting module works with all currently-supported versions (i.e., 2012, 2014, 2016 Pro, etc.) of QuickBooks software, but not with web- or enterprise-based versions.

- All computers on which the Accounting module will be used must have AXIS software, a supported version of QuickBooks software, and the QuickBooks SDK installed.

- Avoid installing QuickBooks software on the server.

Complete the following procedures to prepare QuickBooks software to work the AXIS system's Accounting module.

Set Up a New Company Profile

-

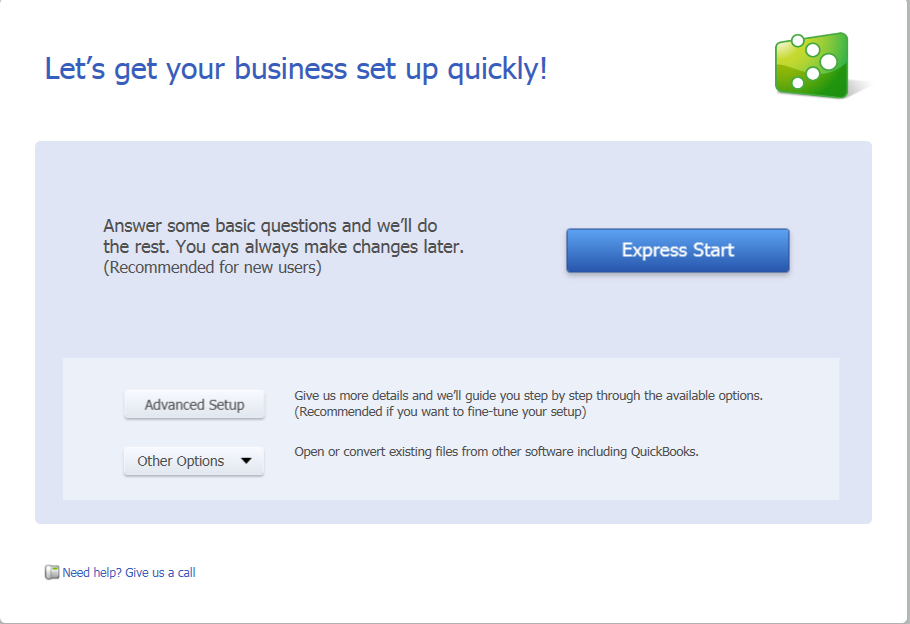

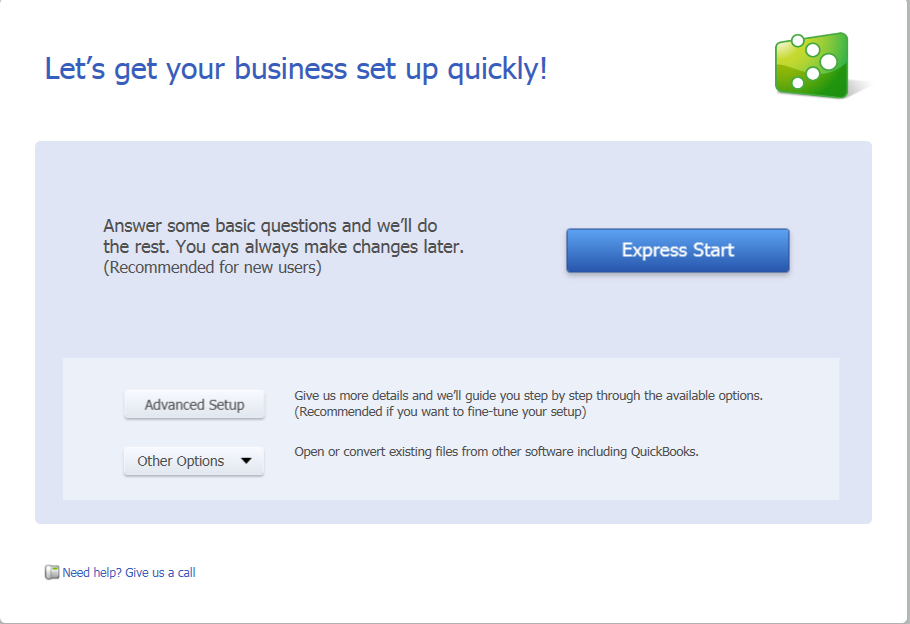

Begin the QuickBooks installation process to display the Let’s get your business set up quickly! page.

-

Click the Express Start button

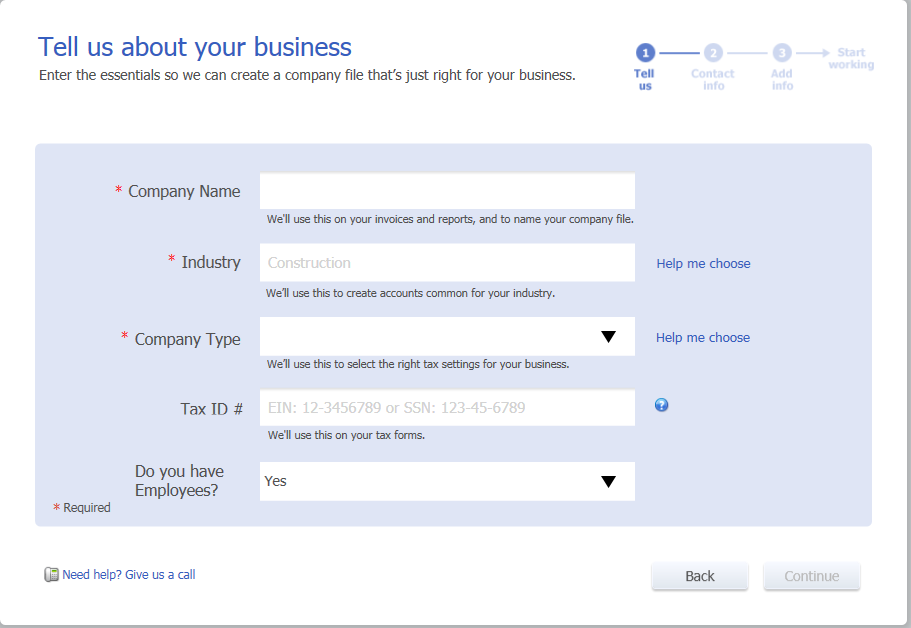

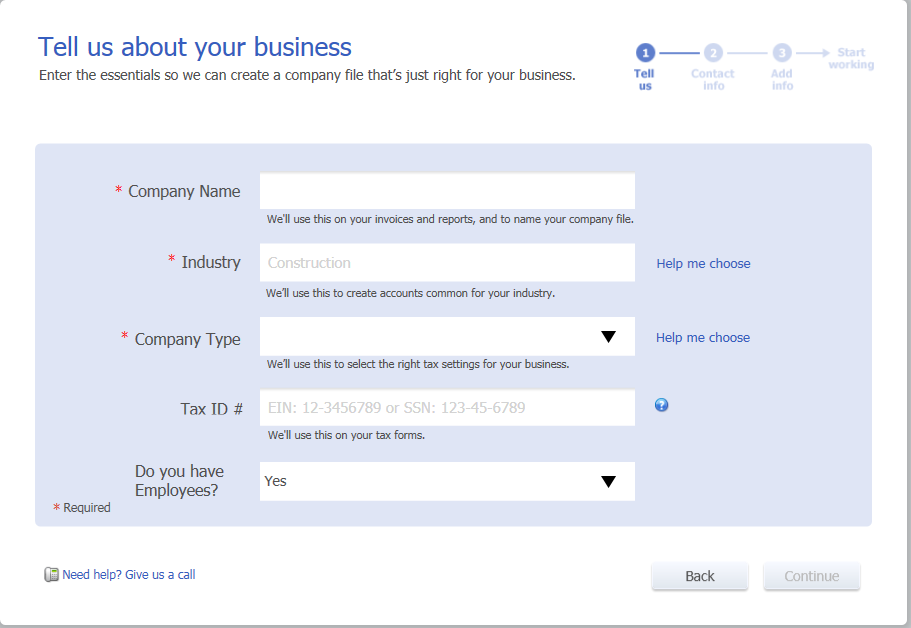

to display the Tell us about your business page.

- Enter the company name (as displayed on the company's FFL License) in the Company Name field.

-

Complete either of the following to populate the Industry field:

- Enter the appropriate industry in the Industry field.

- Use the Help me choose option:

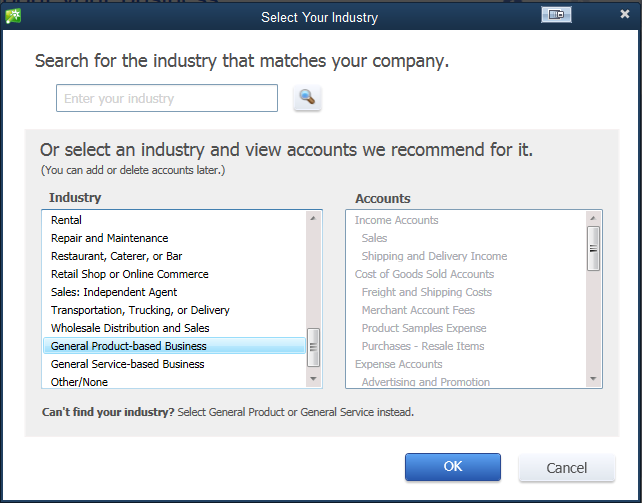

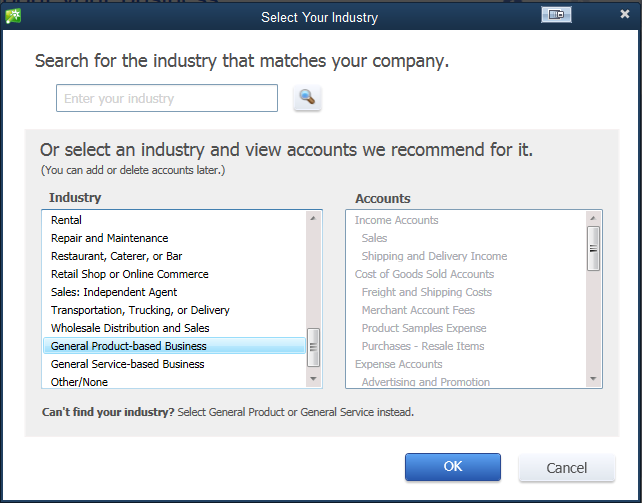

Click the Help me choose option to display the Select Your Industry window.

Complete either of the following:

- Click the OK button to close the window.

Note: The General Product-based Business industry represents an appropriate selection for most retailers.

-

Complete either of the following to populate the Company Type field:

- Select the appropriate company type from the Company Type field's drop-down menu.

- Use the Help me choose option:

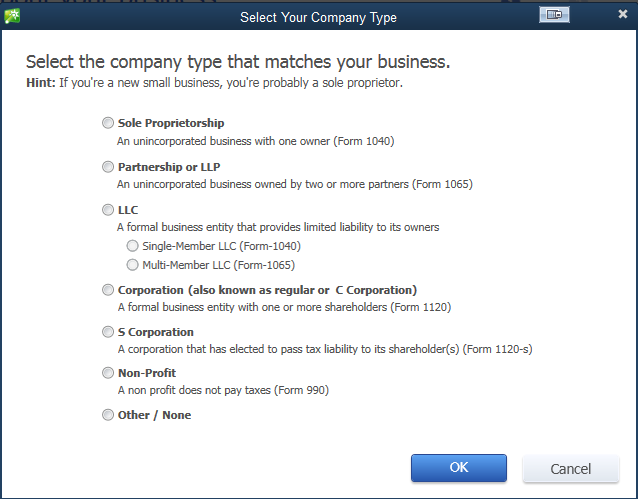

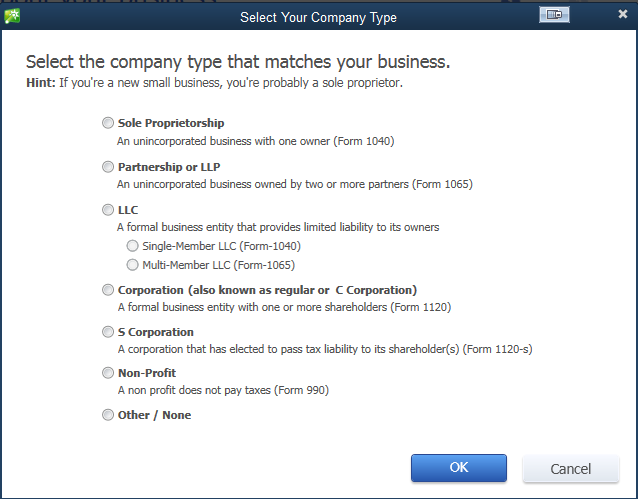

Click the Help me choose option to display the Select Your Company Type window.

Click the corresponding button(s) to select the appropriate company type.

- Click the OK button to close the window.

- Enter the company's tax ID number in the Tax ID # field.

- Select the appropriate answer (Yes or No) from the Do you have Employees? field's drop-down menu.

-

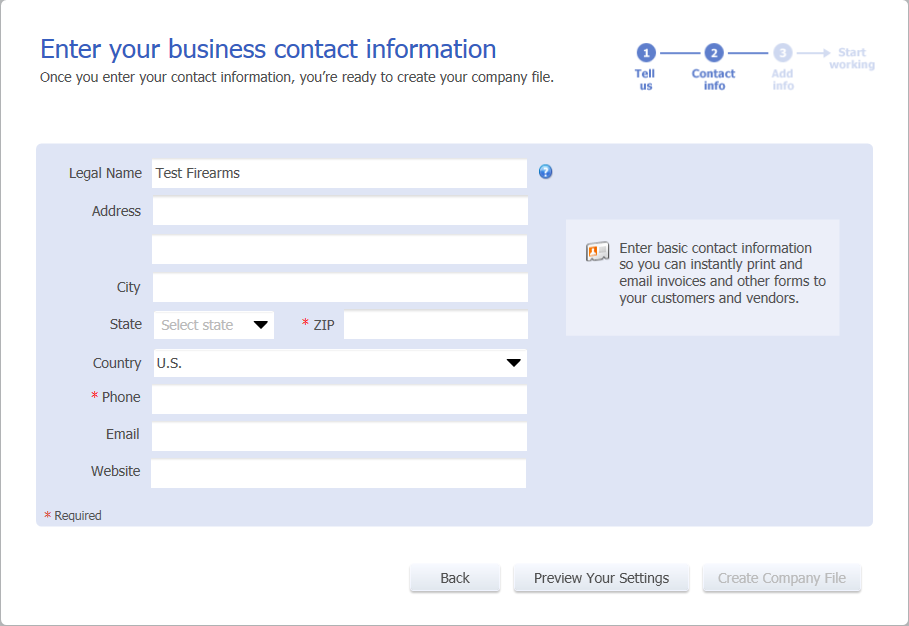

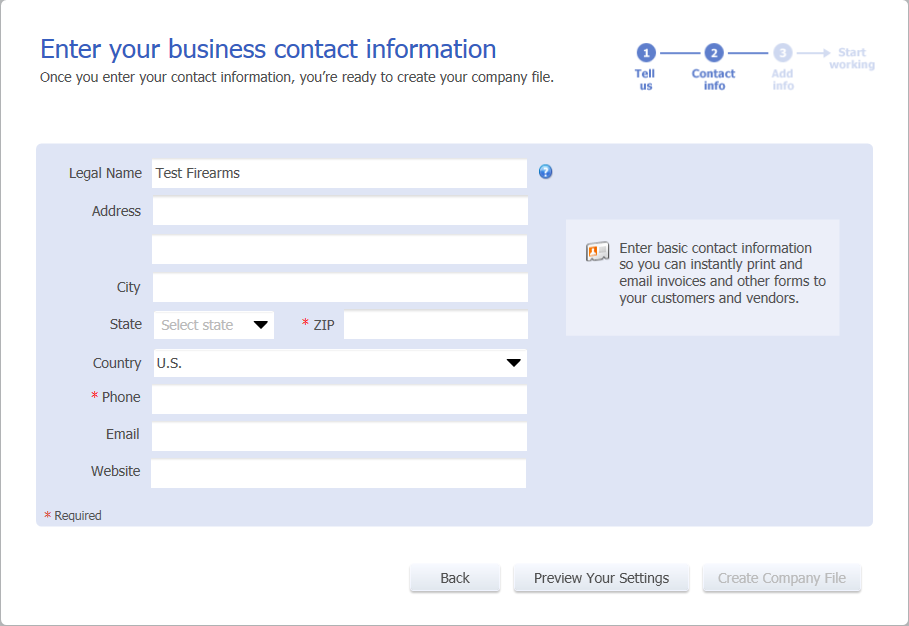

Click the Continue button to display the Enter your business contact information page.

-

Complete the fields on the page to activate the Create Company File button.

Note: The ZIP and Phone fields are required to activate the button, but all fields should be completed if possible.

- Click the Create Company File button to finalize company profile setup.

Set Up a Chart of Accounts

Complete the following procedure to set up accounts in the Quick Books software.

-

Open the QuickBooks application to display the Home window.

-

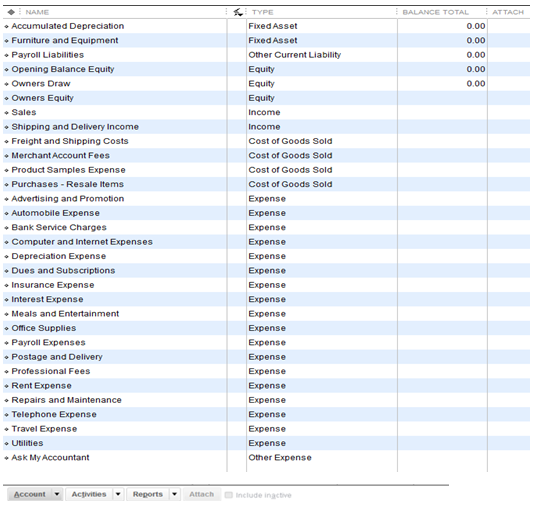

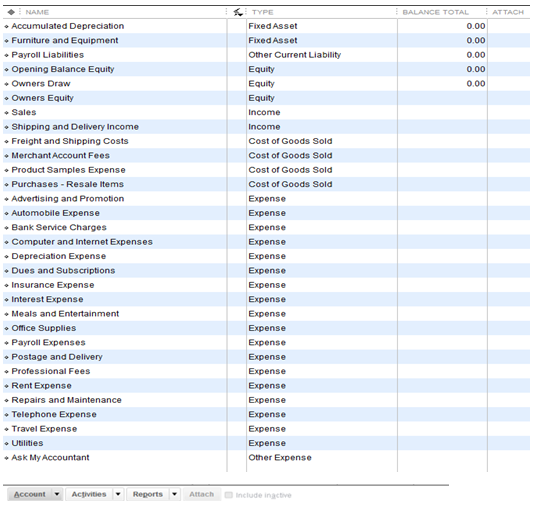

Click the Chart of Accounts button to display the Chart of Accounts window.

-

Complete the following procedure to create an account.

Note: Refer to Required Account Types for information on the types and names of accounts to be created.

-

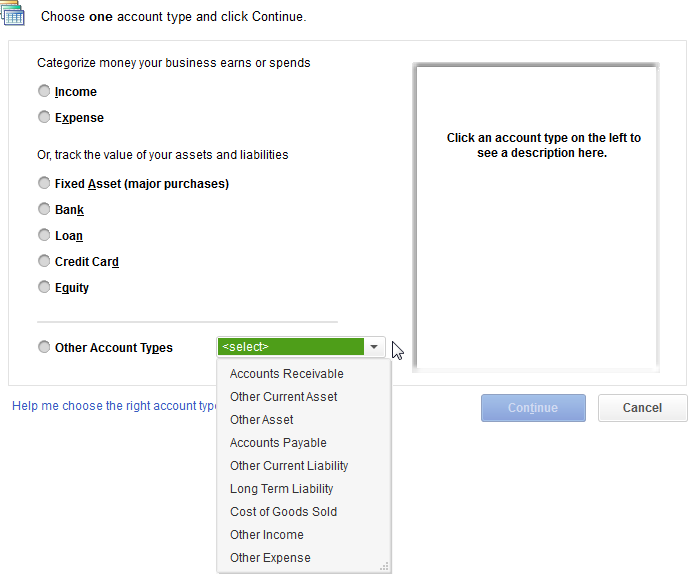

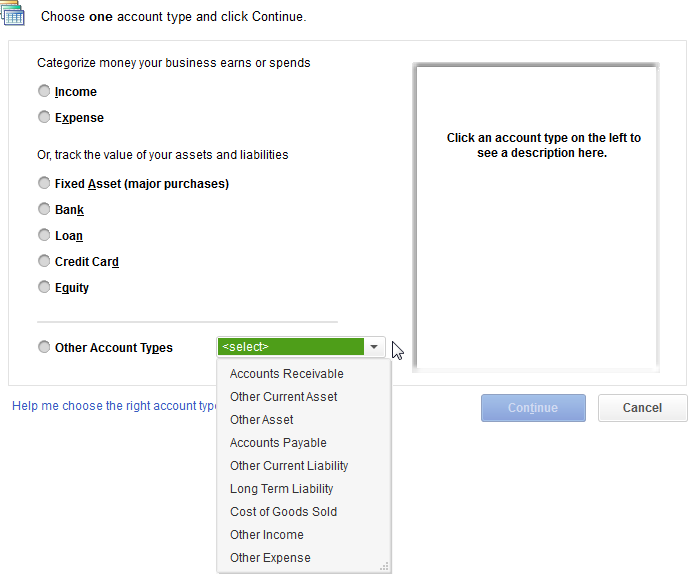

Select New from the Account button's drop-down menu (or press Ctrl+N) to display the Add New Account: Choose Account Type window.

-

Click the corresponding button (and select from the drop-down if necessary) to select the desired account type and display information about it in the description field.

-

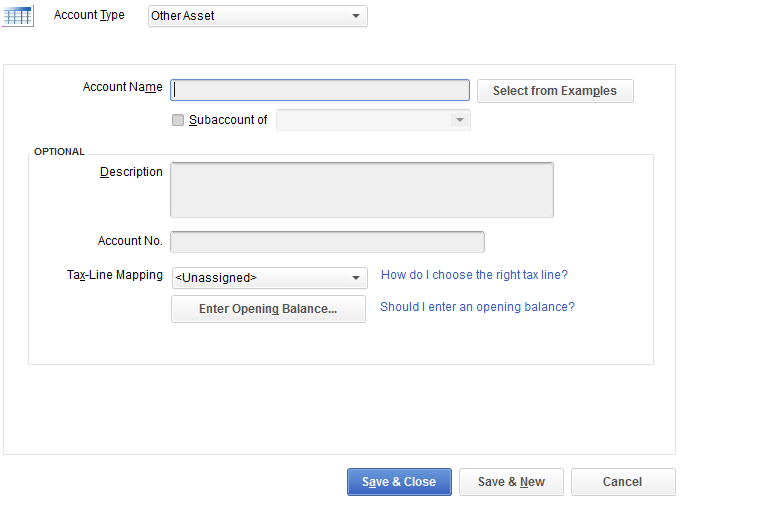

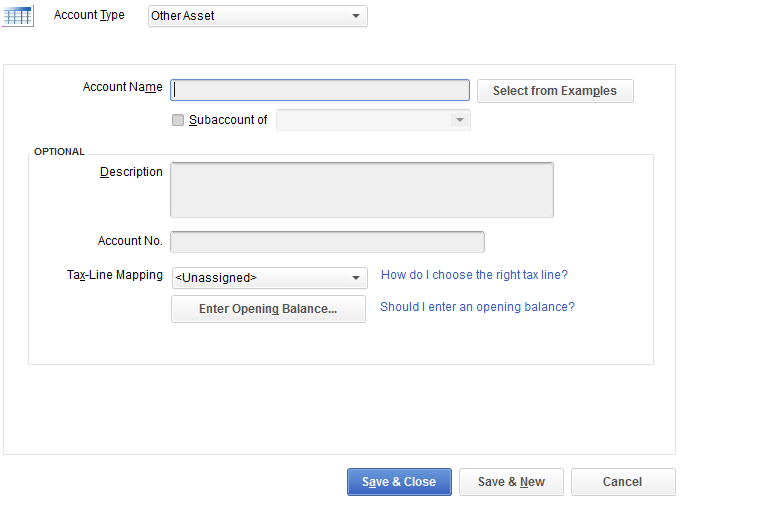

Click the Continue button to display the Add New Account window.

- Enter the desired account name in the Account Name field.

- Enter information in other fields as desired.

- Click the Save & Close button to close the window and display new account in the Chart of Accounts window.

- Repeat this procedure as needed to create additional accounts.

-

When all required accounts have been created,

- Refer to the AXIS Online Guide for more information about setting up the Accounting module.

- When appropriate, Set Up Accounting Links and Features to map Quick Books accounts to Accounting module accounts.

Required Account Types

The Accounting module uses a predetermined set of accounts, each of which has a specific name and represents a particular type (e.g., liability, expense, etc.) of account. Accounts may be created and named as desired in the Quick Books software, but each will need to be linked to a corresponding Accounting module account.

Consider the following suggested account name/type combinations when setting up accounts in the Quick Books software:

|

AXIS Account Name

|

Account Type

|

Suggested QuickBooks Account Name

|

|

WORK ORDER DEPOSIT

|

LIABILITY

|

WORK ORDER DEPOSIT

|

|

LAYAWAY

|

LIABILITY

|

LAYAWAY

|

|

SPECIAL ORDER DEPOSIT

|

LIABILITY

|

SPECIAL ORDER DEPOSIT

|

|

GIFT CARD LIABILITY

|

LIABILITY

|

GIFT CARD LIABILITY

|

|

DEPOSIT LIABILITY

|

LIABILITY

|

DEPOSIT LIABILITY

|

|

SALES TAX ACCOUNTS

|

LIABILITY

|

SALES TAX ACCOUNTS

|

|

AMEX

|

ASSET

|

AMEX

|

|

CASH

|

ASSET

|

CASH

|

|

CHECK

|

ASSET

|

CHECK

|

|

CREDIT

|

ASSET

|

CREDIT

|

|

DEBIT

|

ASSET

|

DEBIT

|

|

DISC

|

ASSET

|

DISC

|

|

MC

|

ASSET

|

MC

|

|

MONEY ORDER

|

ASSET

|

MONEY ORDER

|

|

PREPAID

|

ASSET

|

PREPAID

|

|

VISA

|

ASSET

|

VISA

|

|

(CUSTOM TENDERS)

|

ASSET

|

(CUSTOMER TENDERS)

|

|

HOUSE ACCOUNT

|

ASSET

|

HOUSE ACCOUNT

|

|

ADJUSTMENT ACCOUNT

|

ASSET

|

ADJUSTMENT ACCOUNT

|

|

INVENTORY ACCOUNTS

|

ASSET

|

INVENTORY ACCOUNTS

|

|

PAID OUT

|

EXPENSE

|

PAID OUT

|

|

SHIPPING ACCOUNT

|

EXPENSE

|

SHIPPING ACCOUNT

|

|

DISCOUNT ACCOUNT

|

EXPENSE

|

DISCOUNT ACCOUNT

|

|

COGS ACCOUNTS

|

COST OF GOODS SOLD

|

COGS ACCOUNTS

|

|

SALES ACCOUNTS

|

INCOME

|

SALES ACCOUNTS

|

- (Custom Tenders) is a holding place for any custom tenders that are created by the Retailer within the AXIS system.

- Vendor List coordinates with the QuickBooks Vendor List. Each vendor being utilized within the AXIS system should be mapped in the QuickBooks Vendor List.

|

|

|

|

© 2016 AcuSport Corporation

All rights reserved

|